Lease net present value calculator

It is most commonly associated with car leasing. Ad Research Reports Covering The Single Tenant Net Lease Property Market.

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Net Present Value - NPV.

. The formula for calculating the present value of cash flows is. NPV net present value. Present Value of an Annuity.

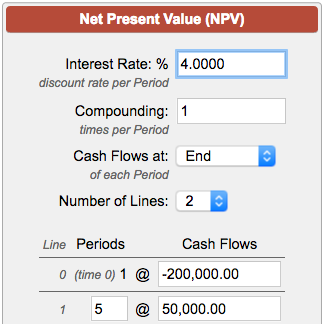

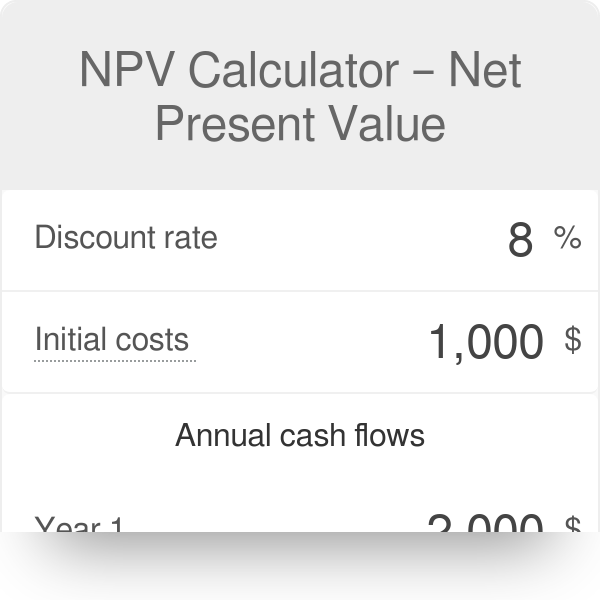

P V P M T i 1 1 1 i n 1 i T where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula.

Present Value CF0 CF1 x 1 1 R1 CF2 x 1 1 R2 CF2 x 1 1 R3. This free calculator allows you to determine your monthly auto lease payments and provides you with an effective method to estimate what your total lease payments will be as well as your net. 1 The NPV function in Excel is simply NPV and the full formula.

Where r is the discount rate and t is the number of. Formula and Steps to Calculate Net Present Value NPV of Lease Accounting and Analysis NPV Net Cash In Flowt1 1rt1 Net Cash In Flowt2 1rt2. All of this is shown below in the present value formula.

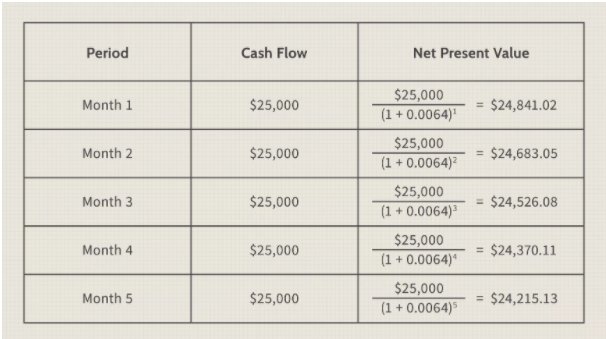

In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. In this example if you purchase the residential lease in the period between 8 July 2020 to 30. The company is looking forward to invest a total.

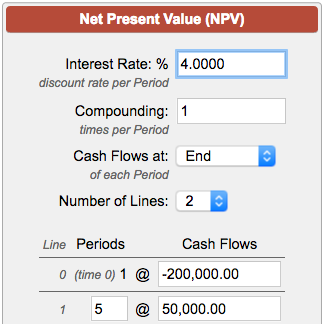

Suppose a company wants to start a new manufacturing plant in the near future. A popular concept in finance is the idea of net present value more commonly known as NPV. Calculate NPV with Example.

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Verify rate factors more. Where CF Cash Flow and R.

Ad Calculate Payments Yields Commissions and more. PV Present Value CF Future Cash Flow r Discount Rate t Number of Years Inputs In order to calculate the present value of lease payments judgements will need to. It is important to make the distinction between PV and NPV.

Pay SDLT on 55000 at 1. To calculate the net present value NPV of rents for SDLT purposes-Find the amount of rent payable in respect of each of the first five years of the term of the lease or for each year of the. Net Cash In Flowtn.

Residual value sometimes called salvage value is an estimate of how much an asset will be worth at the end of its lease. PV FV 1r n PV Present value also known as present discounted value is the value on a given date of a payment. Present Value Calculation Tool GET THE TOOL Download our Present Value Calculator to determine the present value of your lease payments under ASC 842 IFRS 16 and GASB 87.

Add this to the amount of SDLT due on the premium.

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate Net Present Value Npv In Excel Youtube

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Npv Calculator Irr And Net Present Value Calculator For Excel

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Net Present Value Calculator

Formula For Calculating Net Present Value Npv In Excel

Npv Calculator Net Present Value

What Is The Net Present Value Npv How Is It Calculated Project Management Info

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

Formula For Calculating Net Present Value Npv In Excel

Calculate Npv In Excel Net Present Value Formula

Net Present Value

Npv Calculator Calculate Net Present Value